A Plan for Transforming The IGF System™ 5.0 into the world's leading DeRisk Digital Infrastructure Utility

Since its founding in 1985, Investors Guaranty Fund, Ltd. and IGF Principals have pioneered convergence of insurance risk and capital markets through innovative structures and patented technologies.

DeRisk adds a long-term risk mitigation functionality to emerging DeFi and legacy Capital Markets.

The prototype IAC Cube™, which originally issued in excess of USD $300 million in loss mitigation Policies, (floating rate, 30 Year, prepayble, QIB debt obligations) rated "AAA", has been upgraded and extended its core patented risk transformation technologies to support decentralised autonomous organisations ("DAO") creating a bridge between legacy institutions to global "risk nodes", compliant with traditional regulatory structures and industry-standard professional networks.

IAC™ Marketplace envisions a Bermuda-exclusive, sponsored core multi-issuer platform "components" architecture for acceptance, transformation, mitigation, retention and diversification of bespoke and intractable risk exposures which may be difficult to place in traditional markets.

Having created and globally patented "insurance securitisation" and "loss mitigation" instruments with the highest credit quality for more than 30 years, IAC™ Marketplace is designed to enable third parties to Sponsor, participate in and benefit from "Risk as a Service" and IGF's unique, yet approachable and fully-vetted technologies.

During the past decade of substantial regulatory and compliance changes, as well as extreme advances in ai and chip technologies, IGF Principals have focused on transforming implementation and operational infrastructure into an advanced digital "component" architecture which is highly configurable and adaptable for delivering a wide range of risk solutions.

A History of Discovery and Innovation ...

Having invented "insurance securitisation" for transforming insurance risks into capital market obligations, IGF Principals introduce "DeRisk", a strategy for digitally transforming risk through decentralised autonomous organisations ("DAOs"), private digital currency and advanced ai technologies.

Operating through several special purpose component infrastructure utilities, IGF Principal's participated in supplemental income notes and other structured products related to funds with asset values estimated at USD$5 billion of gross assets, including collateralised debt obligations and insurance company surplus notes

IGF Principals acquired an interest in one of the three largest US Municipal Bond broker broker's, similar to an interdealer exchange, and subsequently increased the position to full ownership - the firm was a significant liquidity infrastructure provider in the US municipal finance industry

Investors Guaranty™ was a principal funder of leading global exchange data distribution platforms for most European stock exchanges and now institutional "dark pools", and developer of a leading global forex currency trading system, as well as several ventures involved in global securities industry reference and derived data and related systems

Investors Guaranty™ IT Systems units were early providers of virtualisation and cloud services globally, and developed a wide range of bespoke applications for government, medical, communications, insurance, banking, finance, online merchant trading, operating globally.

Integration of group technologies led to bundling data products for and from leading global financial markets data sources, as well as developing and using advanced tools for cleaning of corporate records for many of the world's leading corporations

IGF Principals were instrumental in funding the world's top risk analytics firm for 200+ large global banks, as well as transforming their leading edge technologies for use in asset management, insurance, portfolio analytics and other markets

Investors Guaranty™ provided funding for development of the leading counterparty legal entity data services provider for top financial institutions, unique identity services for a range of regulatory applications and participated in the UK anti-bribery technology initiative

Investors Guaranty™ acquired various portfolio assets in sports graphics and social media applications, developing "on-air" graphics and services for global broadcasters, a leader in sailing, golf, cricket, rugby, football, soccer and 20 + additional sports

A Look Forward ...

Under The IGF System™ 3.0, IGF's pro forma staffing plan included 250 -500 internal Bermuda staff, consistent with other large insurers formed in Bermuda in the mid to late 1980s. Significant advances in technology are now enabling us to shift operations to advanced "artificial intelligence" platforms, which substantially reduce internal Bermuda staffing and enable wider use of existing Bermuda regulated and sitused Insurance Managers, Corporate Service Providers, Insurance Intermediaries, Securities Broker Dealers, Accountants, Legal Firms, Actuaries, Asset Managers, Custodians, Trustees, Banks, technology firms, local businesses and risk industry professionals.

During the past decade as low interest rates retricted our ability to issue FlexGIA™, our principal funding source, and the extreme pace of assimilating new global OECD|FATF driven regulations, IGF principals turned their attention, to developing a form of replicable Digital Twin paired hybrid of original assurance, insurance and financial guaranty insurer subsidiaries of IGF.

From a technology standpoint, these are similar to "cloud" based instances which can be simply "spun up" in a few minutes, ready for operations. All procedures, contracts, etc. are standardised under IAC™ Rules and Regulations of The IGF System™, which have been operational for 20+ years.

We updated corporate governance structure to integrate more closely with IGF Act's confidentiality and personal privacy provisions, outsourced day to day oversight to regulated Bermuda insurance managers, and are creating application protocol interfaces ("API") for third party market participants to interact with each IAC™ Insurer for which they are accredited and Policies, Programs, Initiatives and Functionalities for which they are certified.

As a stand-alone trio of assurance, insurance and financial guaranty insurers, with a gateway node, a limited -third party staff operating under The IGF System™ 5.0 Executive Directorate format, can integrate closely with a number of IAC Cube™ instances to facilitate exception surveillance and other administrative activities in conjunction with Insurance Manager and Board.

Each IAC Cube™ is designed in a manner similar to high speed algorithmic trading platforms operating on modern exchanges, servicing global 3rd party market participants. The IGF Act enables a wide array of risk permutations in a modular fashion, including in securitisation, tokenisation, digital assets and currencies.

To effect the proposed Three Year Strategy, significant ai automation is necessary, as our efforts in the past few years, to apply IGF technologies to myriad uses globally, has developed pro forma program implementations for more than 1000 IAC™ Insurers associated solely with O|Zone™ Port Authority Opportunity Zone™ Initiative, designed to support risk exposures exported to Bermuda from United States before the end of the decade.

Referring to the opening paragraph above, and to our objective in the above paragraph, we should note potential additional impact on Bermuda in hospitality and services sectors as each IAC™ Insurer is required to have 5 directors, one of which must be located in Bermuda. We estimate a need for at least 250 new local professional directors providing multiple directorships and estimate more than 10,000 Director visits per year to the Island, as well as visits from an unestimated number of Sponsor representatives associated with each IAC™ Cube.

In addition, IGF Principals intend to propose to our Regulators, a new form of participatory daily fee structure from each IAC™ Insurer as a part of our new continous surveillance, sufficiency, validation, consensus, persistence, payments and governance Protocols.

A PROTOCOL designed for HUMANs, ORGANISATIONs and INTELLIGENCEs

At the turn of the century, a group of non-profit, charitable educational foundations were formed to evolve new computing technologies, transform Communities, enhance Quality of Life, respect Personal Privacy and transition Humankind to a Digital Paradigm

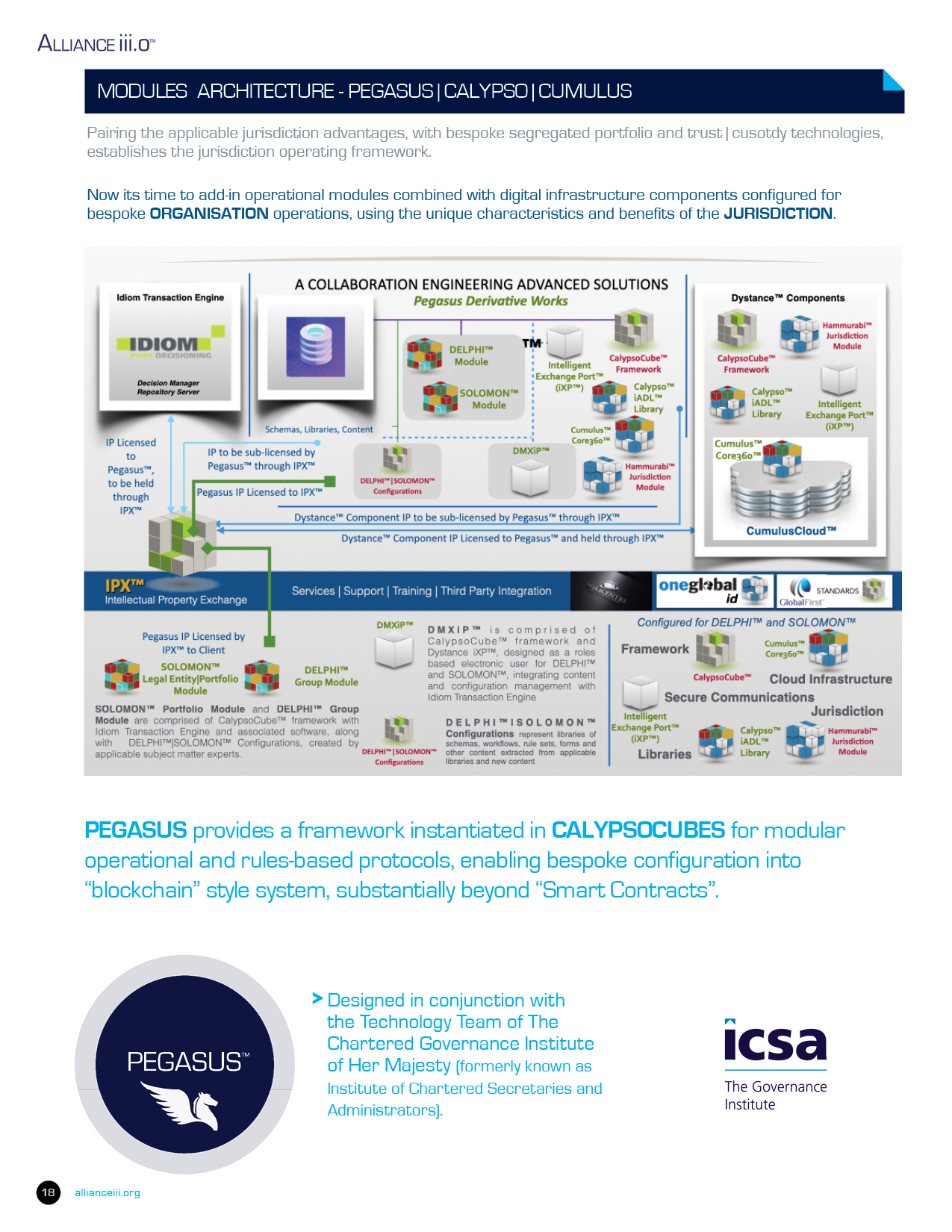

More advanced than "blockchain", data and processes which change its state, reside within CalypsoCube™, in a secure encrypted framework which may synchronise with multiple mirror cubes in various locations.

Calypso Cube™ instances may be located in mobile devices, Internet of Things (IOT) devices, desktop, latptop and cloud, in essence, across your digital devices.

Your phone, tablet, laptop, desktop, watch or IOT device is an "edge" device. It can store, process, and communicate, generating Revenue for you. It can connect with n number of networks and with HUMANs, ORGANISATIONs and INTELLIGENCEs worldwide and beyond.

Alliance iii.o is designed for an individual with a mobile phone (an "edge" device) or connecting all of their devices... for ORGANISATIONs and INTELLIGENCEs as well...

Form core team, develop concept, apply seed funding, form ISO, establish PROTOCOL SPONSOR

Define core DAO PROTOCOL, select additional DAOs for inclusion, develop currency, value, NFT and transactional allocation details and economics

Select and configure PROTOCOLs and COMPONENTS, add new requirements, integrate with applicable Community, overlay on Network and Gateway Protocols

Select and configure applicable Digital Asset types, build funding matrix, develop allocation Protocol, complete final Governance Protocol, schedule roll-out plan

Waterhouse Protocol sets up registration of the Protocol with GlobalFirst™, creates core Identity, network and addressing framework, establishes links to authorised version publishing platform and connects core IP use and production framework.

Next, Pegasus Protocol establishes the core data, process and metadata schema framework.

DAOs | APP Infrastructure -

A

Component Network benefits from a Decentralised Autonomous Organisation

("DAO") of participants, by reducing jurisdictional situs risk, creating

a digitally enforced governance protocol and one or more means of

transacting between participants.

The APP Framework, enables an array of Component Integration when designing and implementing a new PROTOCOL.

At this point, the base Protocol components have been mapped and are now ready to add additional component integration, configurations and specialty provisions to facilitate interactions with one or more Ecosystems.

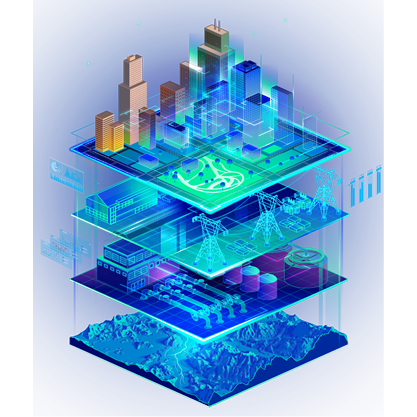

This section focuses on traditional "Infrastructure Utilities" which are evolving with "Digital Twin" technologies to enhance economic interaction, velocity of money and increase economic growth to improve local Community Quality of Life.

For particpants wishing to use this Component Digital Infrastructure Architecture of Alliance iii.o, the following information may be useful in constructing a new PROTOCOL to be available for local and/or global use.

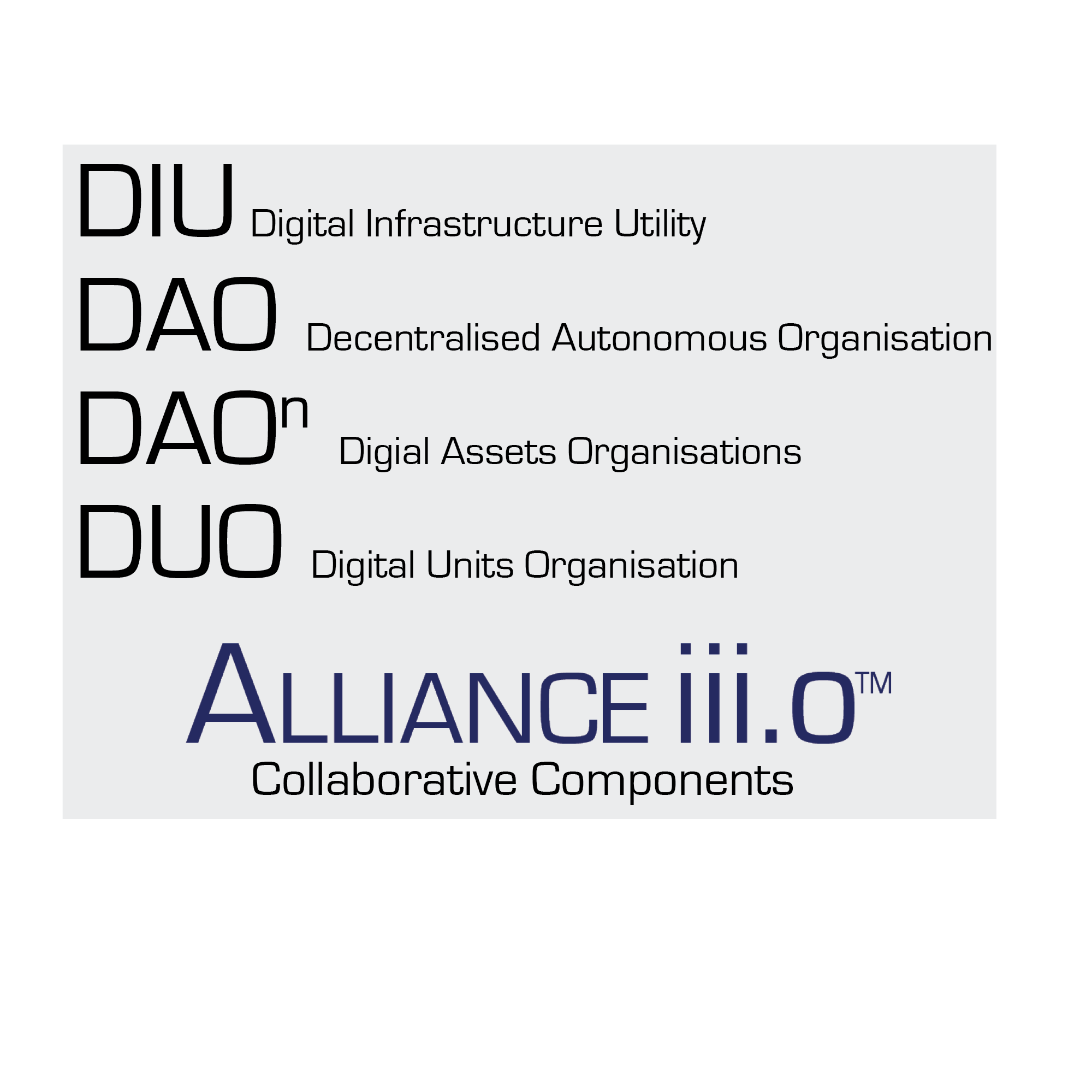

Each type of Digital Organisation is highly configurable, designed to integrate with traditional organisations as a Digital Twin, mirror traditional types of HOMEWORLD organisations, as well as operate within DIGITALUNIVERSE based on its applicable Governance Protocol.

These ORGANISATIONs may operate with a nexus to one or more HOMEWORLD jurisdictions, or be layered on top of an "atomised" nodal mesh with no centralised nodes.

The IAC™ Marketplace Protocol represents a "bridge" from legacy institutional financial | risk | capital markets systems and operations to what comes next in DIGITALUNIVERSE and the role of "ai" in commerce, our individual activities and improving Quality of Life.

The customised section of the Protocol involves the core objectives, procedures, components, etc.

As illustrated above, our 40 years of operations in HOMEWORLD have experienced significant regulatory changes in the past decade. These legacy issues must be included in the Protocol.

In addition, it is useful to anticipate those requirements for operating in DIGITALUNIVERSE in the future, where most of continuous operations will be driven by INTELLIGENCEs.

Some of the Components are specific to IAC™ Marketplace and are thus within IAC™ ECOSYSTEM and some Components are Infrastructure Utilities used by IAC™ Marketplace Participants.

The Protocol establishes a GOVERNANCE framework for the ECOSYSTEM, its Components and Operations.

Establishing an International Sponsor Organisation

Configuration of Core IAC™ Marketplace and third-party Components

Protocol DAOs and Component Integration

Digital Assets developed for new Protocols

The IAC™ Ecosystem is defined by the IAC Protocol. Its objective is to undertake a business model which transforms IGF's historic operations into a "risk" marketplace, and evolves through DX - Digital Transformation and advanced AI. The benefits of these efforts and creation of an expanded ECOSYSTEM are primarily to be embodied in a form of token, designed as a "currency" for use within a decentralised autonomous organisation or "DAO" which relates to its participants and through various Digital Infrastructure Utilities ("DIU"), Digital Units Organisations ("DUO") and Digital Assets Organisations networks ("DAOn"). In addition, various affiliated Protocols and their related ECOSYSTEMs are embedded to establish a robust transitional ECOSYSTEM.

IAC Digital Currency Units ("iAC dcu") are at the center of participation of individuals and entities in what is being envisioned as a global risk currency. Unlike fiat currency, it is designed to be supported by IAC ECOSYSTEM revenues and assets derived in part from a percentage of Policy residuals, earnings from IGF, expansion of new IAC Cube™ instances, and use of IAC as a global risk currency. The following sections describe in more detail, the implementation regime for establishing an ECOSYSTEM under a Master Protocol, benefited by embedded Protocols and their affiliated token structures.

WHAT IS A DECENTRALISED AUTONOMOUS ORGANISATION?

A Decentralised Autonomous Organisatio

n ("DAO") may be viewed as a group of HUMANs, natural legal persons, non-natural legal persons (often referred to as juridical persons) and/or, with the recognition of robots by UAE and digital intelligences by other countries, i.e. INTELLIGENCEs. It may also include digital nodes and other types of tangible and intangible assets.

Decentralised indicates the network has no "central" point. Further, a DAO is autonomous. In essence, it has a set of governance conditions, similar to bye-laws of a company, which cannot be changed without participants within a DAO agreeing to effect such alterations. Finally, it has the broadest definition of "organisation", if essence, a method of assembling discrete elements, rather than a fictitious legal person.

Well, that's one definition! With more than 18,000 "digital currency" protocols, let alone n number of digital assets, use tokens, non-fungible tokens, etc., there are similarities, there are n differences between DAOs.

The above might be descriptions written by non-technical parties. When we peer deeper into actual technology implementation, differences become more plentiful and impactful. For example, existence of a server node, might give rise to a central point, thereby creating a "jurisdictional" nexus of a DAO, subjecting it and/or its participants to the laws of a particular jurisdiction, if not multiple jurisdictions.

A serverless network properly constructed of adhoc nodes with atomised processing, memory, storage, and network interaction with "edge" devices and logical containers, may enable a compelling argument that such DAO is ajurisdictional, i.e. without physical jurisdiction, or its jurisdictional attributes are solely within its own governance, consensus and sovereignty.

For example, one might argue that a DAO comprised solely of HUMANs under UN Declaration of HUMAN Rights, might be considered a sovereign DAO. Such ORGANISATION might include in its GOVERNANCE PROTOCOL ("Constitution") a means of voting consensus to alter the parameters of interaction between the HUMAN participants of the DAO.

This new approach is not without governance, consensus and voting requirements within the DAO.

The design of a DAO and its "bridge" or "connection" points becomes particularly important. Fortunantely, centuries of precedence provide guidance, for example, "free trade zones", "ports", and "agents".

JURIDICAL DAOs

Recently various US States, including Wyoming, and other jurisdictions have created juridical recognition of DAOs which file within their jurisdiction. While these might be useful, one can argue they are not then "decentralised" or "autonomous". Arguably, the DAO and its participants may come under the laws of the specific jurisdiction.

CURRENCY DAOs

Jurisdictions such as Wyoming USA, have enabled exceptions to money transfer regulations for digital currency which is registered in their jurisdiction.

In recent years, non-legal technologists and even lawmakers have simply included defintions of "crypto-currency" "protocol" and "decentralised autonomous organisation" or "DAO" on a combined basis within a structured arrangement ("sometimes referred to as a Protocol"), even including them into new laws passed in various jurisdictions. The net impact may bring in Protocol, DAO, Participants and Currency into a state jurisdiction, and a federal jurisdiction.

Rather than creating a Currency DAO, elements of a Currency may be better defined in a PROTOCOL, with elements of Currency movement and exchange integrated between a transport DAO and a DAO establishing relationships between parties.

JURISDICTION AS A SERVICE

This concept is different than "Government as a Service". Using a Component in a particular jurisdiction may give rise to a range of benefits and use cases.

Hence, establishing a "bridge" between various types of DAO and Components can be particularly useful. Design of a PROTOCOL, with DAOs, Currency and Digital Assets, as well as Component architecture involves more than techonologists, but rather a multi-disciplinary and multi-jurisdictional team.

My DATA is My DATA ?

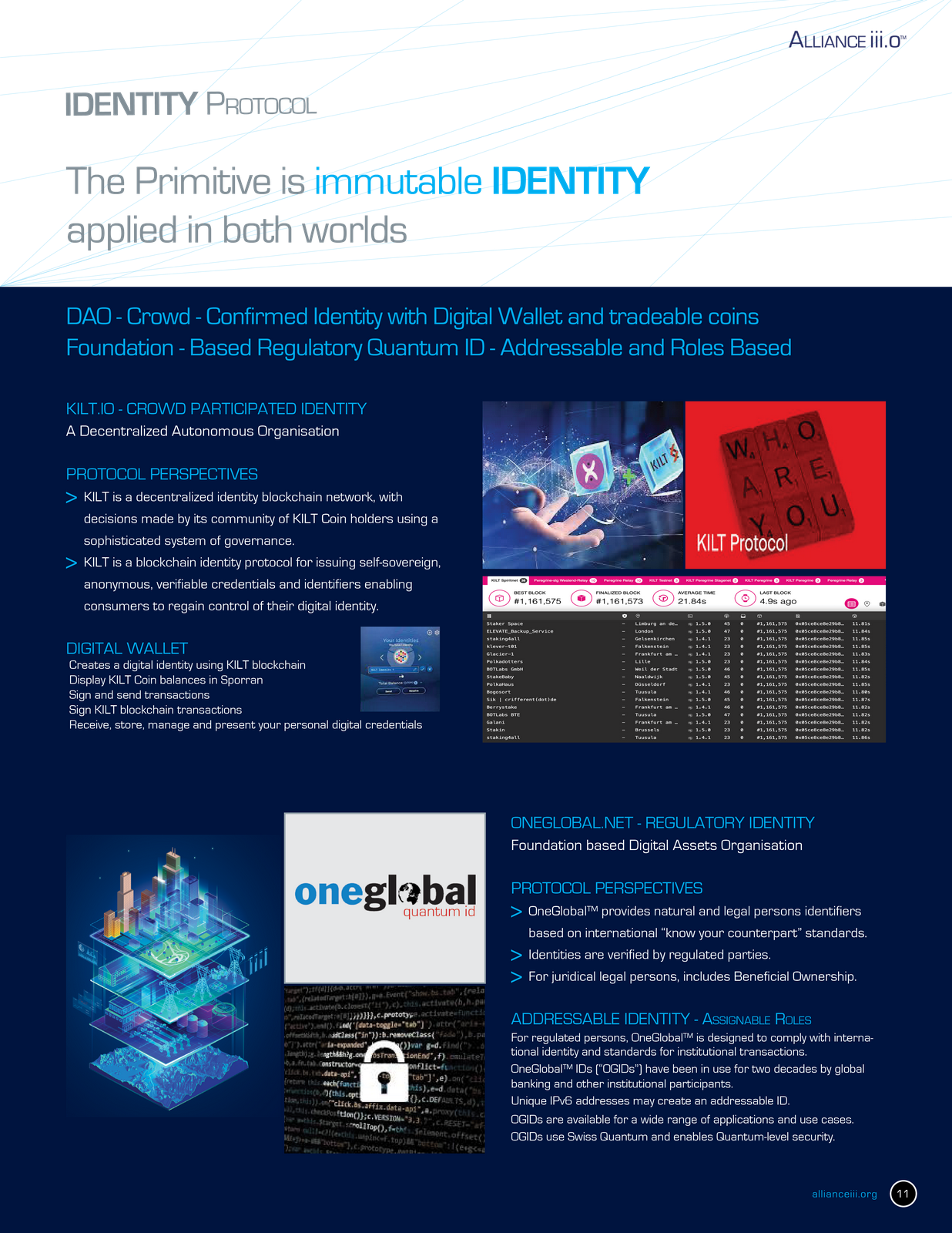

Alliance iii.o begins with the HUMAN, then ORGANISATION which may include HUMAN and INTELLIGENCE. Addition of Waterhouse Protocol establishes identity of the foregoing, assignment of unique addresses and publication of authorised version of "known counterparty", as determined by counterparty.

Alliance iii.o is designed to facilitate identity of intellectual property and intangible assets ("IP|IA") and apply applicable property rights.

DAOs may facilitate immutable Terms of Service for use of Data and Other IP|IA, unlike current practice which enables data distributors rights to change Terms at will.

In keeping with international treaties related to Intellectual Property rights, defining data and creative works as property of the HUMAN who created it, establishes a different contractual framework for use of such content.

The model creates an author, publisher, user relationship controlled by the owner or assignee.

ELEMENTS AND ATTRIBUTES

It is important to separate these concepts, as has been the practice in law for millenia. For example, a DAO might refer strictly to methods and means of transport, storage, security, access, etc. The adhoc nature of both tangible and intangible assets within such a continously coalescing relational mesh may itself sustain sufficient but microsecond permanence of atomised digital particles on a singular pseudo-random and now true Quantum random pathway, never to be repeated. How can a "country" exert its "jurisdiction".

Each endpoint, among myriad ending and beginning points, is simply a receiver or a "digital firing mechanism" of a "packet" whose message is unintelligible".

A DAO relating to HUMAN, ORGANISATION and INTELLIGENCE, designed to facilitate and accommodate myrid elements and attributes which are synergistic when used with a transport DAO, may be useful for highly sensitive activities and for parties who value privacy and security.

Generally, these concepts are well understood in international trade, conveyance, transfer of ownership and other such concepts, and may be easily overlain within information technologies, but rarely are subject matter experts of such archaic concepts in law, invited into the development teams of modern IT. Neither are newer concepts, such a "STAR" Issues, i.e. Security (Securities), Tax, Accounting and Regulatory.

Alliance iii.o incorporates more than 40 years on contextual information technologies, where juridiction matters, how something is built and how it does something may be more important than what it does.

Individuals underwriting insurance known as "Lloyd's Names" have been known globally for centuries.

The concepts of Underwriting Members and implementation of one or DAOs combine an old concept and new technologies, to create the potential for globally robust organisations whose members individually access risk exposures to underwrite and assume.

The opportunity to diversify across extraordinarily large numbers of participants, individually creating portfolios of risks, based on individual preferences and risk tolerance.

As a new perspective, the technologies applicable to digital assets, enable small amounts to be risked by millions of participants... for example, large numbers of people buying small lottery tickets.

An Underwriting Member assuming levels of single risk exposure acceptable to them to take a total loss, across large numbers of participants, are expected to provide substantial funding of higher levels of risk exposure which generate proportionately larger amounts of premium.

The ability of these Underwriting Members to benefit from decimalisation of these risks, is designed to further enable these risks to generate even higher premiums with more diversification.

The unique design of IAC Currency as a global risk currency enables an opportunity to create a "risk ecosystem" transacting in IAC Currency.

IAC Currency Reserve is proposed to provide transactional capital and surplus to IAC Cube™ IAC™ Insurers to add new forms of risk profiles within assets supporting IAC Currency.

Smaller amounts of widely diversified types of risk ("MicroRisk") may be further facilitated through IAC Currency converted to AGM currency for micropayments and risks in Digital Assets | Currencies.

Integration of Underwriting Members combined with IAC and AGM currencies may expand global markets for types of bespoke and intractable risk solutions which may be transacted across IAC Cube™ instances.

IAC™ Marketplace is designed as a "logical compute" platform evolving to ai Intelligences enabled digital infrastructure with limited HUMAN interface and operations over the next decade.

Each Component within IAC™ Marketplace is a core group of technologies and HUMAN resources. Their respective incentives are focused on optimising the specific Component. For example, management of IGF will be incentived to enhance IGF shareholder value and liquidity.

As an independent organisation, IAC Currency Reserve and its Board of Governors are designed to focus on IAC Currency, increasing its Reserve Assets, expanding its use, creating liquidity and new uses within IAC Ecosystem and undertaking actions to increase its value.

Management of other IAC™ Marketplace Components are incented to optimise the particular functions of their Component.

A focus of DX - Digital Transformation is evolving operations to digital ai enabled interaction, with HUMAN activities escalated to more senior positions, creating additional and higher paying jobs within Bermuda.

As artificial Intelligences become more prolific, we believe it it important to maintain a core group of contactable HUMAN participants with a focus on innovation and the best interests of IAC™ Marketplace and its participants and, by design, that group is the DAO - IAC Society™ and its members.