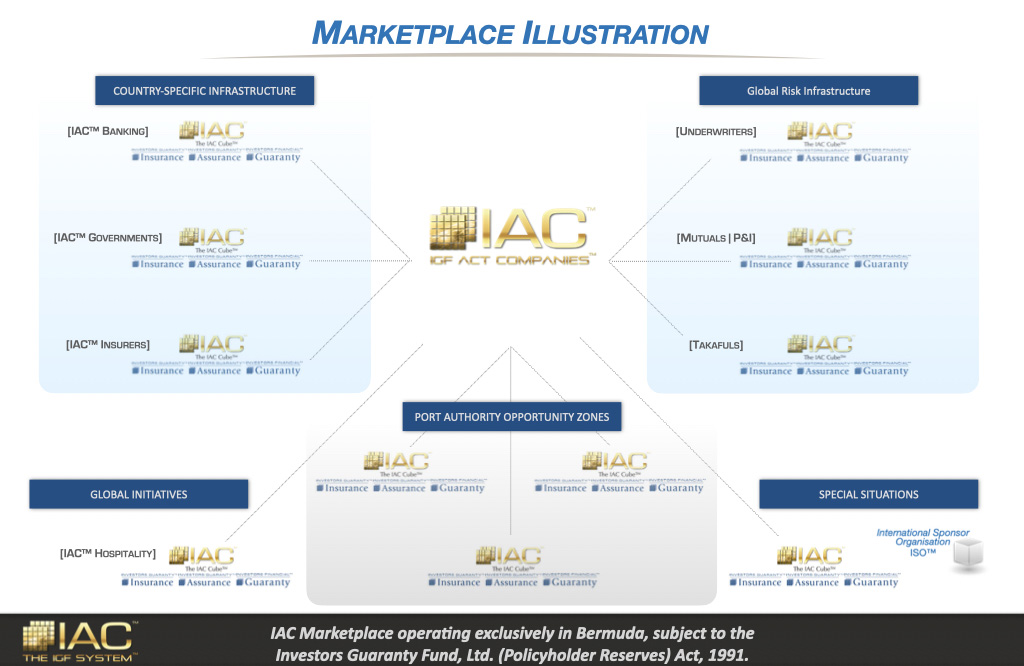

Each digital trio of IAC™ Insurers "an IAC Cube™", must be wholly-owned by IAC ISO, IGF's parent to access IGF Act. Accredited Sponsor Groups may apply to form an IAC Cube™.

IAC ISO is in formation and transition to become "parent" of IGF core operations/technology unit, with IGF retaining its current shareholder base.

The concept of IGF's three insurance subsidiaries, original protoype for IAC Cube™ concept, is comparable to licensing use of core operational technologies within IAC Cube™ framework, a successful concept developed, prototyped, operated, then repeated many times. By way of additional comparison, each IAC™ Insurer might be compared to a Lloyd's Syndicate.

Of significant difference, however, is that IAC™ Insurers must always be capable of timely paying a 100% total loss on all Policies issued and the capital markets approach to capital | surplus funding.

A broad range of IAC™ Market Participants and Underwriting Members are to interact with individual sponsored IAC Cube™ insurers, each governed by a 5 person Board of Directors with no controlling interests, subject to IAC™ Rules and Regulations of The IGF System™, the IGF Act and agreed operational parameters set out in the Protocol of each IAC Cube™.

Of important note is that each IAC Cube™ operates as a series of "Digital Twin" instances which implement operations for each IAC Cube™ originally agreed with an accredited Sponsor group, IGF Core and IAC ISO, approved by applicable Bermuda regulators.